A. Right of Redemption

The essential right vested with a mortgagor in a mortgage is a right of redemption, which transfers back to the mortgagor, the same right that was mortgaged. This right is incidental to every mortgage and it continues to be in existence notwithstanding the default on the part of the mortgagor to pay the debts.[1] Sec 60 in the Transfer of Property Act, 1882 deals with the right of Redemption. The right of redemption begins once the principal amounts become due.[2] The kind of redemption varies, according to the form of mortgage. There can be three primary kind of redemption – i) delivery of the title documents and the mortgage deed, ii) delivery of the possession back to the mortgagor, iii) reconveyance of the mortgaged property in favor of the mortgagor.[3] A mortgagor, in order to redeem, needs to file a suit for redemption. Order XXXIV Rules 7, 8, and 8A deal with suits for redemption of mortgage of immovable property. A mortgagor is entitled to this right till the mortgaged property is foreclosed or is sought to be sold by the mortgagee.[4] However the mortgagor cannot exercise his right of redemption till the debt becomes due.[5]

B. Right of Foreclosure

Section 67 of Transfer of Property Act, 1882 defines foreclosure as “A suit to obtain a decree that a mortgagor shall be absolutely debarred of his right to redeem the mortgaged property is called a suit for foreclosure.”[6] Thus it is a tool by which the mortgagee can deprive the mortgagor of his right interest in property, by barring his right of redemption. However, this right to foreclose the mortgage property is not existent in all forms of mortgage. A simple mortgage, usufructuary mortgage, English mortgage, equitable mortgage doesn’t find this right to foreclose. Therefore, in such mortgages, other remedies such as a suit for money decree or for sale of the property can be exercised.

Section 67 is the counterpart of S. 60 of the Transfer of Property Act, 1882, therefore the right to foreclose only occurs after the debt becomes due.[7] The right of foreclosure gets diminished in cases where the mortgagor has deposited the mortgage money.[8] Therefore only once the mortgagor has defaulted on the debt becoming due, can the mortgagee exercise this right. This right is only available in cases of mortgage by conditional sale and certain kinds of anomalous mortgage.[9]

C. Right to Sale

Certain forms of mortgage provide a right to sue for sale by intervention of courts. Simple mortgage, Mortgage by deposit of title-deeds, and English Mortgage, transfers the right of the mortgaged property to be sold by an order of the court.[10] Order XXXIV Rule 14 mandates two conditions for a suit under Order XXXIV Rule 15 for sale of mortgaged property, they are – that such claim must arise out of the mortgage, and that the mortgagee must be allowed to bring a suit for enforcing his mortgage.[11] English mortgage is the only mortgage that vests with the mortgagee has the power of sale without intervention of courts. However, this power of private sale is limited to only three instances. The first being where the parties to an English Mortgage are not Hindus, Mohammedans, Buddhists or any gazette sect. Therefore, this form of mortgage applies mainly to companies.[12]

Charge

A charge is another form of security interest mentioned in the Transfer of Property Act, 1882. It is defined in S. 100 of the Transfer of Property Act, 1882 as “Where immovable property of one person is by act of parties or operation of law made security for the payment of money to another, and the transaction does not amount to a mortgage, the latter person is said to have a charge on the property, and all the provisions hereinbefore contained which apply to a simple mortgage shall, so far as may be, apply to such charge.”[13]

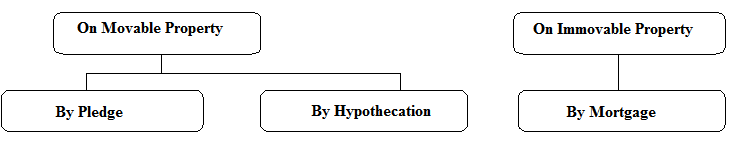

It is to be kept in mind that charge is created by following ways:

It should be noted that in a mortgage there is a charge but a charge is never a mortgage. Charge does not create any interest in the property. Charge is an agreement in which an immovable property is given as security against a debt without transferring any interest in the property. For example: A posses certain immovable property and executes an agreement in favour of B to pay a fixed amount of money annually out of the rents of that property. B has charge on that immovable property.

Following are the essentials of a charge:

- There should be two parties for the creation of charge i.e., the creator of charge and the holder of charge.

- The subject – matter of charge may be any present or future asset of the borrower.

- The intention of the borrower to create a charge on specific asset or property is to provide security for the repayment of any debt with interest.

- A charge should to be entered through an agreement made in the favour of lender of the money.

As in most common law jurisdictions, the two kinds of charge that can be created over assets are (i) fixed charge, and (ii) floating charge. A fixed charge can be created only over an asset that is ascertainable, whether present or in future.[14] A floating charge is usually created on all the assets of the debtor, whether in existence or in the future, ascertainable or not, and crystallises (i.e. becomes fixed) on such assets as are in existence at the time of occurrence of an event of crystallisation.[15] The document creating the charge would typically set out the events of crystallisation but a failure to repay the debt or the debtor ceasing to carry on its business would invariably constitute a crystallisation event. From the time of creation of charge until crystallisation, the debtor has the right to use the assets and deal with them in the ordinary course of business as if such assets are unencumbered, to the extent that it may also have a right to dispose of the assets, if it so agreed between the parties. In a charge, there is no creation of interest in the property.[16] The Apex Court observed this by holding, “…in the case of a charge there is no transfer of property or any interest therein, but only the creation of a right of payment out of the specified property, a mortgage effectuates transfer of property or an interest therein. No particular form of words is necessary to create a charge and all that is necessary is that there must be a clear intention to make a property security for payment of money in present.”[17] Hence, a charge is a right of payment out of a property, without any transfer of interest.

Illustrations

- X mortgages a certain plot of land to Y and afterwards constructs a building on it. Y is entitled to the building and land as security for the loan.

- A in lieu of loan mortgages his property and also handovers the possession to B until the loan and the interest is paid. B has the right of possession and to enjoy it till the dues are settled.

Frequently Asked Questions (FAQs)

-

What are the essentials of a mortgage?

Following are the essentials of a Mortgage:

- Transfer of Interest: To give effect to a mortgage it is necessary that there is the transfer of any immovable property to mortgagee until all the dues are recovered.

- Specific Immovable Property: The property which is to be transferred must be specifically and distinctly mentioned in the mortgage deed. Where mortgagor mentions ‘all the [property’ in the deed is not a mortgage as the property is not identifiable.

- Securing the Payment of Loan: Another essential of a mortgage is that the transfer of property must be to secure the repayment of a loan or an obligation. That is, the mortgagor and mortgagee share the relationship as that of debtor and creditor.

-

What are the rights of a mortgagee?

A mortgagee possesses one right against the property and another against the mortgagor personally.

- If the money is not recovered from the mortgagor in the specified time the mortgagee has the right to recover from the proceed of the property, or

- Mortgagee can sue the mortgagor for the recovery of the money.

Approved & Published by – Vedanta Yadav

[References]

[1]Rashbehary Ghose, Law of Mortgage, Kamal Law House (S. P. Sengupta ed., 2006).

[2]Ibid.

[3]Id.

[4]Id.

[5]Id.

[6] S. 67, Transfer of Proper Act, 1882.

[7] Supra note 21.

[8]Ibid.

[9]Ibid.

[10]Ibid.

[11]Ibid.

[12] S. 69, Transfer of Proper Act, 1882.

[13] S. 100, Transfer of Property Act, 1882.

[14]Claire Martin-Royle, ‘Floating Charges: Not Necessarily What They Say on the Tin’, available at: http://www.jonesday.com/files/Publication/60ba3b1a-58b3-42de-ab3d-c2d628af566c/Presentation/PublicationAttachment/2f2c219d-6313-4f63-b93f-c70b9d3582a2/IHL157%20p73-75.pdf.

[15]Ibid.

[16]Ibid.

[17] J. K. (Bombay) Pvt. Ltd. v. New Kaiser-I-Hind Spginning and Weaving Co. Ltd. and JuggilalKamlapat Bankers and Ors. (Creditors), [1969] 2 SCR 866.